How Much Does Tribal Knowledge Cost Your Credit Union?

ARTICLE SUMMARY

- There are mental health, financial, and opportunity costs when your credit union relies on tribal knowledge.

- To escape tribal knowledge and improve knowledge operations, you need to stop relying on tribal knowledge and start relying on guided knowledge (aka move up the Knowledge Ops Maturity Model).

- The Find & Follow Framework can help you make the change from tribal knowledge to guided knowledge.

Does your credit union rely on tribal knowledge?

Tribal knowledge is a common knowledge management and transfer strategy in credit unions — and, yet, it is the most expensive knowledge transfer strategy. And it’s not just expensive fiscally.

In this post, you’ll first want to check the list of six common symptoms. It will help you determine if your credit union is running on tribal knowledge. Then find out what tribal knowledge is costing your company. And, finally, figure out how you can escape tribal knowledge by moving to guided knowledge.

6 symptoms of tribal knowledge in your credit union

Credit unions that rely on tribal knowledge find themselves in one or more of these situations:

- Supervisors are overwhelmed with employee questions

- Employees feel stressed and lack confidence

- The credit union provides Inconsistent member service

- Onboarding times are drawn out (lasting more than a month)

- Employees take a long time to reach proficiency (commonly up to 18 months post-start date)

- Change management takes a long time (employees have a low or inconsistent adoption of new technologies)

What is the cost of tribal knowledge?

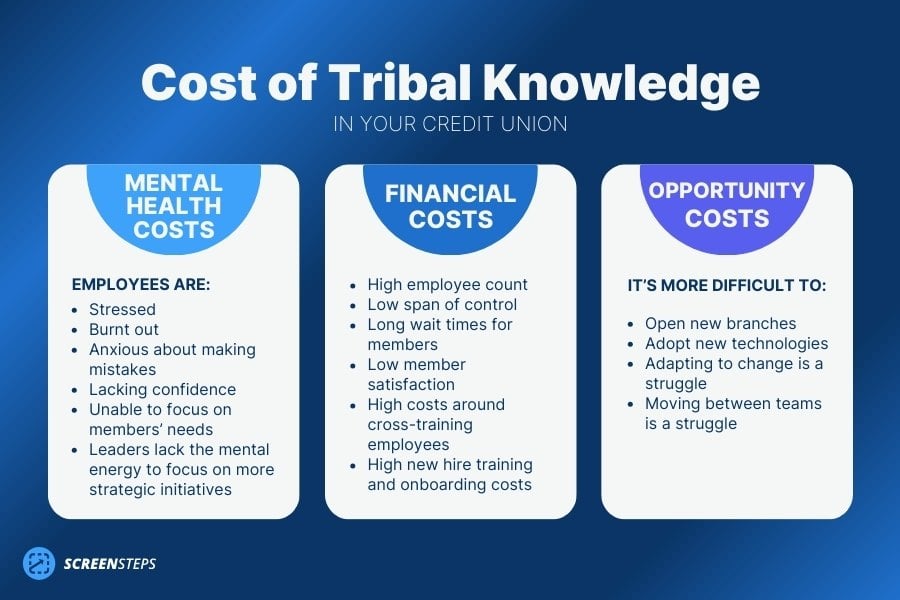

The cost of tribal knowledge goes beyond the economic impact. When your company relies on tribal knowledge, the cost involves the mental health of your employees, the financial losses from inefficient operations, and the lost opportunities from the extra time needed to manage everything.

How do these costs add up? Here are the specifics.

1. Mental health costs

One of the greatest impacts on a company is your employees’ mental health. Mental health affects employee performance, employee retention, and, consequently, customer reviews.

These six mental health consequences are the price you pay for relying on tribal knowledge.

A. Employees are stressed

When your employees are required to memorize everything, that increases their mental load. Their brains have to work hard to remember everything and handle the various tasks.

In a credit union, you have hundreds of policies and procedures. This increases the amount of stress your employees experience.

B. Employees experience burnout

Both new hires and supervisors experience burnout. To achieve excellent member service, supervisors make heroic efforts to make sure things run optimally. Unfortunately, that load causes them to burn out.

C. Employees have anxiety about making mistakes

Employees, especially new hires, are worried they will do something wrong. They can’t remember everything they were asked to memorize. And this leads to the next mental impact.

D. Employees lack confidence

When employees are confused or worried about messing up, they are often paralyzed. They are afraid to make decisions on their own. They feel a need to confirm the next steps with a supervisor or co-worker, which slows down the procedure.

E. Employees lack of mental energy to focus on members’ needs

Because employees lack confidence and are worried about making mistakes, they can’t focus on member’s needs. Their minds are too preoccupied with the little things. This exhausts their mental energy and makes it harder for them to give the member their full attention.

F. Supervisors & managers lack the mental energy to focus on more strategic initiatives

Supervisors and VPs are expending too much energy constantly putting out fires. They are constantly in a place where they need to be reactive to the events of the day instead of proactive in preparing for the future.

This prevents them from getting into a mental space where they can think about growing the organization.

2. Financial cost

When you think of “cost,” you typically think of the economic impact. Tribal knowledge has a huge impact on your bottom line. When you rely on tribal knowledge, you have to hire more people to serve the same number of members.

Here are six financial challenges that are a result of your credit union relying on tribal knowledge.

A. High employee count

You need more employees to serve fewer members. When it takes longer for employees to do something, you either have to make people wait or hire more people.

When they are operating on tribal knowledge, everything takes longer. (When they are operating on guided knowledge, everything takes less time.)

B. Low span of control

You need more supervisors to oversee employees. Since employees are dependent on asking supervisors for support (aka tribal knowledge), you need fewer employees assigned to each supervisor.

So, it takes one supervisor to oversee four employees. If you moved away from tribal knowledge to guided knowledge, that span of control could expand to one supervisor for 10 employees.

C. Long wait times for members

Because it takes employees longer to handle procedures, your credit union members end up spending more time waiting.

D. Low member satisfaction

Long wait times and dependent employees typically lead to lower customer satisfaction scores. That’s because members are frustrated. They spend a long time waiting or they have to call your credit union back multiple times to handle a single situation.

Financial services is a very competitive market. Ultimately, if members are dissatisfied with your credit union's service, members may take their business elsewhere.

E. High costs around cross-training employees

It costs a lot of time and money to cross-train and upskill your existing employees. For many credit unions, it can take as much as 12–15 months to cross-train an employee in a new area of the business.

During that time, the employee is pulled from their job, which means others have to cover their work.

F. High new hire training and onboarding costs

Does your new hire training take more than a month? It’s a common practice for credit unions to take three months for training. It takes even longer if you are going to have your employees shadowing and nesting.

And it can take up to a year or even 18 months for new hires to be proficient at their jobs. During that time, they are dependent on co-workers and supervisors for support.

You could save a significant amount of your budget by having a shorter training.

3. Opportunity cost

What opportunities are you missing out on because of tribal knowledge? When your credit union operates on tribal knowledge, you lose out on other strategies that can propel your credit union forward.

Here are four ways tribal knowledge could be slowing down growth in your credit union.

A. Open new branches

One growth opportunity is opening new branches or acquiring/merging with another credit union. Before you can open these new locations, you need to train all these employees. And this can involve long shadowing times.

The longer onboarding process means you lose out on operations time. With guided knowledge, you could open your new locations faster.

B. Adopt new technologies

To run a credit union, you need a good technology stack. These applications and software services help you better serve your members. However, each piece of technology requires employee training.

Employees need to learn how to use the technology and where to find and handle the different tools they need. With tribal knowledge, that process takes longer.

C. Adapting to change is a struggle

Change management is difficult when your credit union relies on tribal knowledge. If you are undergoing a digital transformation or there are changes to regulations, it can take months to adopt those changes. Unfortunately, some of those changes need to be adopted immediately.

The problem is employees have to unlearn what they’ve been doing (maybe for years!) and relearn how to handle procedures the new way. Even changing one step in a process can be difficult when an employee has been doing a procedure one way for years.

What ends up happening is you get a mix of the old way of doing things and the new way, which means members get an inconsistent experience.

D. Moving between teams is a struggle

It’s difficult for employees to move between teams. That’s because it requires additional training (cross-training).

When training is in the details (i.e. clicks, step-by-step procedures, etc.), it means employees need to spend a lot of time learning and memorizing a whole new area. They are required to become experts in every area (i.e. checking, mortgages, investments, etc.).

How do you escape tribal knowledge?

At this point, you have identified whether your credit union operates using tribal knowledge. And you’ve probably identified a variety of areas where tribal knowledge is costing your credit union time and money.

How do you escape tribal knowledge?

For the answer, let’s look at the Knowledge Ops Maturity Model.

The Knowledge Ops Maturity Model

/Updated-Knowledge-Ops-Maturity-Model.png?width=1000&height=535&name=Updated-Knowledge-Ops-Maturity-Model.png)

The Knowledge Ops Maturity Model is a scale to help businesses identify how effectively they transfer knowledge.

Credit unions that operate on tribal knowledge typically fall in the Tribal Stage or the Document Stage of the Knowledge Ops Maturity Model.

If you want to escape tribal knowledge, you need to move to guided knowledge. Guided knowledge comes into play when you are in the Guide, Train, and Accelerate Stages of the Model.

Once you’ve identified where you are at on the Knowledge Ops Maturity Model, you can use the Find & Follow Framework to move up the Model and into guided knowledge.

Where are you on the Knowledge Ops Maturity Model?

You can take the free self-evaluation here to see where your credit union fits on the Knowledge Ops Maturity Model.

Find & Follow Framework: Moving to guided knowledge

The Find & Follow Framework provides a roadmap on how your credit union can move from tribal knowledge to guided knowledge.

Find & Follow uses a combination of technology and habits to create a culture based on guided knowledge. It helps you create an employee training and onboarding program as well as create a single source of truth for all of your company’s documentation (i.e. standard operating procedures, policies, call flows, etc.).

The results? With Find & Follow, you can:

- Decrease employee stress with reliable digital guides at their fingertips

- Onboard employees faster, reducing training costs

- Provide better customer support

- Increase compliance

- Decrease task time, helping employees find the right guides faster

- Increase employee independence

Want to learn more about Find & Follow? Download our free playbook outlining the framework. Or if you want a more detailed guide, you can buy the book on Amazon. Find & Follow is available in paperback, Kindle, and audiobook formats.

Cut your credit union costs by moving to guided knowledge

You may feel overwhelmed by the challenge of tribal knowledge, but you can solve it. You just need a full solution that provides you with the right technology and the right framework. The Find & Follow Framework is the solution.

ScreenSteps developed the Find & Follow Framework to help businesses optimally transfer knowledge using our knowledge ops platform. The ScreenStep knowledge ops platform helps you execute the Find & Follow Framework.

You can create and update digital guides quickly. Employees can access guides in as few as two clicks with the Chrome extension and advanced search capabilities.

With ScreenSteps, credit unions can onboard employees in 30 days or less. One contact center decreased cross-training time from weeks to just one hour.

Ready to see how Find & Follow can help your credit union escape tribal knowledge?

Take our free 30-minute course introducing the basic concepts of the Find & Follow Framework.