Credit Union Hiring: Why it’s Difficult to Retain Entry-Level Employees?

Why is it so difficult to keep new hires around? Are entry-level employees quitting in the first weeks or months of working at your credit union?

Hiring and retaining employees at a credit union can be challenging — especially for entry-level positions. How do you flip the script on the revolving door of hiring?

At ScreenSteps — a knowledge ops solution that helps credit unions transfer knowledge more efficiently — we’ve seen this challenge in most credit unions we work with.

As you understand the circumstances and challenges these entry-level employees face at your credit union, you can better prepare for and prevent new hires from quitting your credit union.

Here are six reasons why it is difficult to hire and retain entry-level employees in your credit union.

At the end of this post, we provide you with a framework that helps improve your new hire’s training and work experience. Stick around for a free playbook and course that will help you improve hiring and employee retention.

1. You are hiring Zoomers for entry-level jobs in a post-Covid world

Don’t mistake what I’m saying here. I’m not saying you shouldn’t hire Zoomers (Gen Z). Gen Z has a lot of good qualities that translate well into the workforce. This is more of a commentary on the work environment and Gen Z’s perspective on work.

Gen Zers were born between 1997 to 2012. The oldest Gen Zers graduated from college in 2019 and part of their initiation into the workforce was a worldwide pandemic that sent everyone working from home. Younger Gen Zers finished their high school careers taking remote classes and may have done many of their college classes in a remote or hybrid classroom environment.

Whether they liked it or not, Gen Z was introduced to a world where we're increasingly doing more and more work from home — and they may have felt disconnected if it wasn’t done well.

On the flip side, many may have gotten used to the idea of working from home (or anywhere in the world). Now that they’re required to come into a building and wear business casual attire, they may not like that as much.

Gen Z employees by the numbers

Here are a few statistics gathered from different reports that explain Gen Z’s attitude towards their jobs.

- 83% of Gen Z consider themselves job hoppers. Job hoppers are people who quit and jump to another job. (ResumeLab, 2023)

- 55% of Gen Z workers report they are “very likely” to look for a new job in the next 12 months. (Bankrate, 2023)

- 91% of Gen Z workers feel extremely stressed in the workplace. (Cigna, 2022)

2. You’re hiring pool has no financial background knowledge

You need entry-level employees, but there aren’t enough workers available who have background knowledge in banking and credit unions. While your employees may have an associate’s or bachelor’s degree, that training wasn’t necessarily in finance.

And the bad news is that most people in the United States are financially illiterate.

In the 2023 P-Fin Index questions, a quiz evaluating how well people understand financial terms and concepts, the TIAA Institution found that only 48% of those quizzed answered half of the 28 questions correctly.

This is something to keep in mind as you are hiring and training your new hires. You are likely hiring individuals who are inexperienced and don’t have foundational knowledge in a world where financial services are becoming more and more complex.

And if you don’t have a great onboarding and training program in place to efficiently give them that knowledge, the job can feel incredibly overwhelming.

3. Credit unions are complex

While tellers and call center reps are considered entry-level jobs, these positions must be able to handle over 500 different requests at any given time.

They also have to use dozens of different systems and applications to perform day-to-day tasks.

Entry-level jobs have to deal with a lot more complexity than they used to. This includes complexity in procedures and complexity in memorizing a high volume of information.

An entry-level position in a credit union needs to know an umbrella of general topics. A few of those topics include:

- ATM

- Banking

- Cash handling

- CDs

- Checking

- Credit cards

- Debit cards

- EFTs

- High Yield Savings

- IRA

- Loan payments

- Online and mobile banking

- Trusts and power of attorney

- Wire transfer

While these topics range from simple to more complex, as mentioned above, your hiring pool doesn’t always have a financial background. This can make what you consider a simple task more complex for a newer MSR.

By sheer numbers and the cognitive load, entry-level positions at credit unions are overwhelming. Often, this leads entry-level employees to search for less complex job options elsewhere.

4. Member-facing roles are stressful

When you add together the new territory of learning the financial world and the complexity of the transactions and questions entry-level employees handle, new hires often feel overwhelmed by all they need to do. They feel stressed.

That doesn’t even take into consideration the added pressure of talking to members and handling these procedures in front of them. Most of your entry-level positions are member-facing positions.

Let’s put it this way:

New hires are stressed. They don’t feel confident. They hate their job, and so they quit.

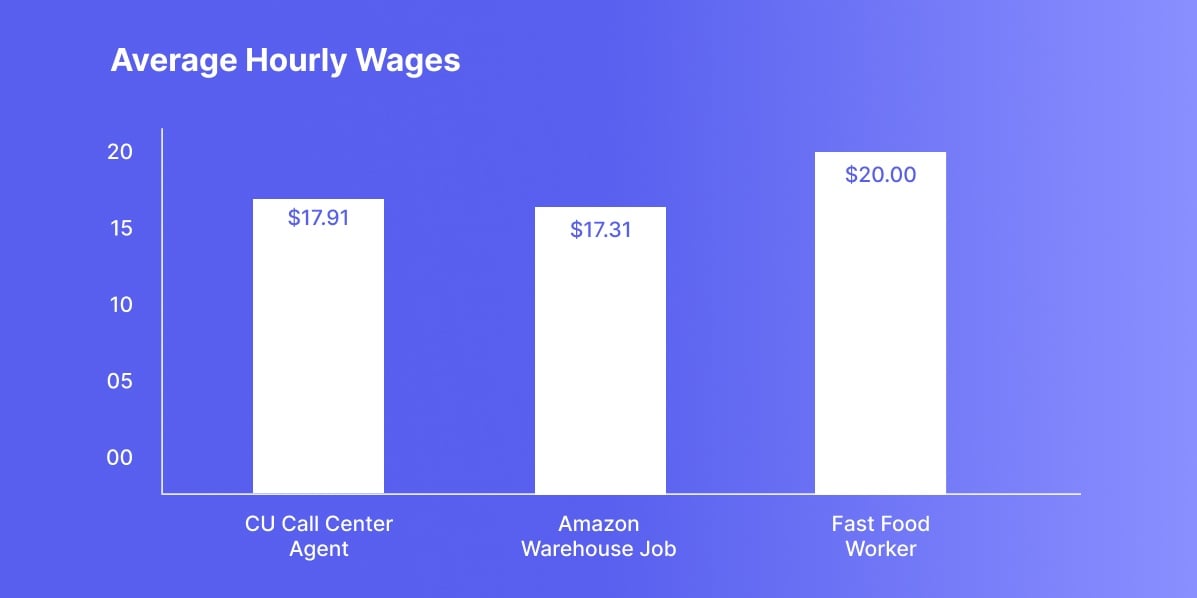

5. The complexity and stress of the job don’t match the pay

Not only are your entry-level positions stressful, but employees don’t feel they are properly compensated for the level of stress they handle on the job.

Employees can only take so much stress. When people are feeling stressed and overwhelmed, they look for other jobs that are less stressful or “easier.”

On average, a call center agent at a credit union in the United States makes an average of $17.91 per hour, according to ZipRecruiter.

Alternatively, the average hourly wage for an Amazon Warehouse job is $17.31 per hour (ZipRecruiter) and the average wage of a fast food worker in the U.S. is $20 per hour (ZipRecruiter).

Your tellers and other entry-level employees are recognizing that these jobs are less complex and less stressful.

While salary is important, what Gen Z really wants is to feel engaged and successful. And if they’re not feeling it at their current employer, they’ll leave and go somewhere else.

6. You have no training plan

Looking at all of the challenges your entry-level employees face in your credit union, you know you need to be able to effectively onboard new hires. Unfortunately, many credit unions don’t have a robust training program to do that.

Many credit unions we’ve spoken to rely on shadowing and on-the-job training. Essentially, it’s a kind of “sink or swim” approach.

Some new employees make it and they stick around for years. But credit unions are seeing a trend of higher attrition rates than what they’ve experienced in the past. And many employees on their way out are letting HR know that they didn’t feel like there was good training.

We’ve noticed that many credit unions also rely on off-the-shelf training for compliance and regulatory topics, but those resources don’t get into the weeds of how to actually handle transactions and respond to questions.

In other words, the curriculum doesn’t adequately cover the background knowledge they need AND the transactional knowledge they need AND the soft skills they need.

What are the results? New hires leave training feeling unprepared for the job or they don’t have training at all.

How to improve training at your credit union

If you want to retain your entry-level employees, you need to have a plan. Your first step is understanding the circumstances of the member-facing roles you are hiring. Hopefully, this article has helped you with that.

Next, you need to improve training and reduce complexity so that you have a less stressful work environment.

Keeping in mind that you are hiring many Gen Z employees, you need to create a training program that teaches them in a way they are used to learning. Zoomers want intuitive training that matches how they naturally learn new things. That’s not lecturing and shadowing.

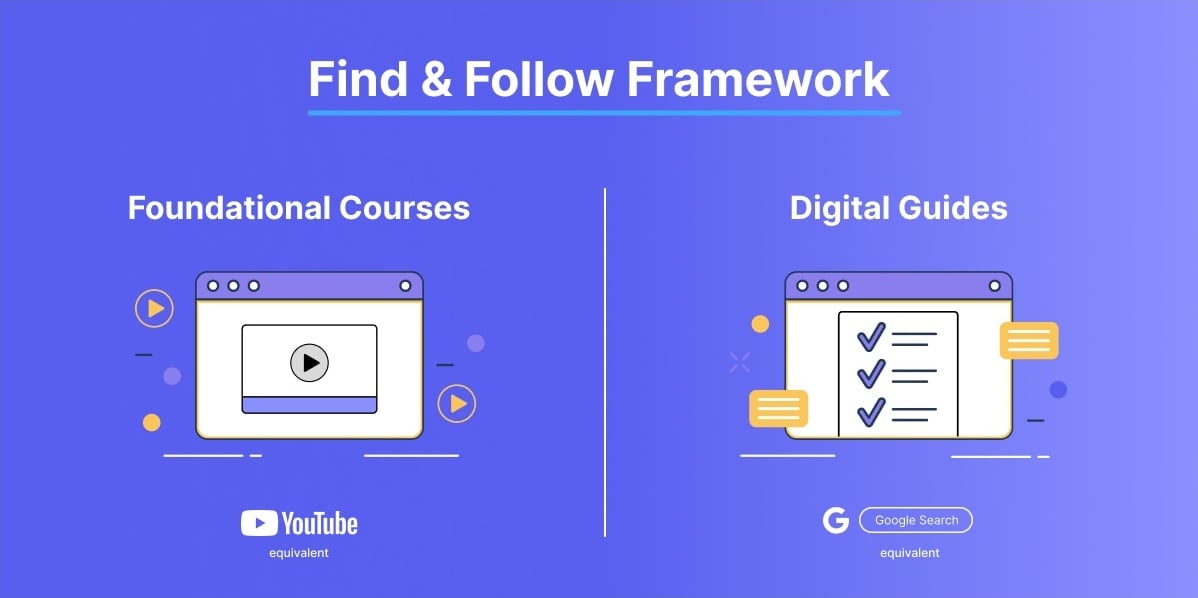

How does Gen Z learn? Typically, Gen Z learns through online research via sites like YouTube and Google Search. At ScreenSteps, we created the Find & Follow Framework to help credit unions better (and faster) prepare their employees for their jobs.

Find & Follow Framework

The Find & Follow Framework is a method that encourages credit unions to use technology and habits to create a culture of guided knowledge. The framework uses a combination of foundational courses and digital guides to train and support employees in their work.

Foundational courses (YouTube equivalent)

Leverage courses that include videos. These videos teach industry foundational principles and concepts so new employees can get up to speed quickly and effectively.

Digital guides (Google Search equivalent)

Create an internal Google that employees can turn to when they need to know how to do something (or how to respond) to the over 500 tasks, questions, and requests they get daily.

Get a broad overview of how the Find & Follow Framework works with this free 30-minute Find & Follow introductory course.

Ready to improve hiring and employee retention at your credit union?

Working for a credit union can be stressful. If you reduce that stress, you’ll see better connections between your employees and members.

You need a solution that can teach entry-level employees foundational knowledge about credit unions AND how to handle the 500+ questions and requests they get on a day-to-day basis.

You need a knowledge ops solution. Our ScreenSteps knowledge ops solution helps credit unions simplify the employee learning experience so that employees can feel more confident in their jobs. Paired with the Find & Follow Framework, ScreenSteps helps credit unions train employees in 30 days or less. And those employees are more independent.

Ready to improve the employee experience at your credit union?

Download the free Find & Follow Playbook to learn how to implement Find & Follow training at your credit union. For more in-depth learning, you can buy the full-length book on Amazon in paperback, Kindle, or audiobook form.

.png)